The challenge

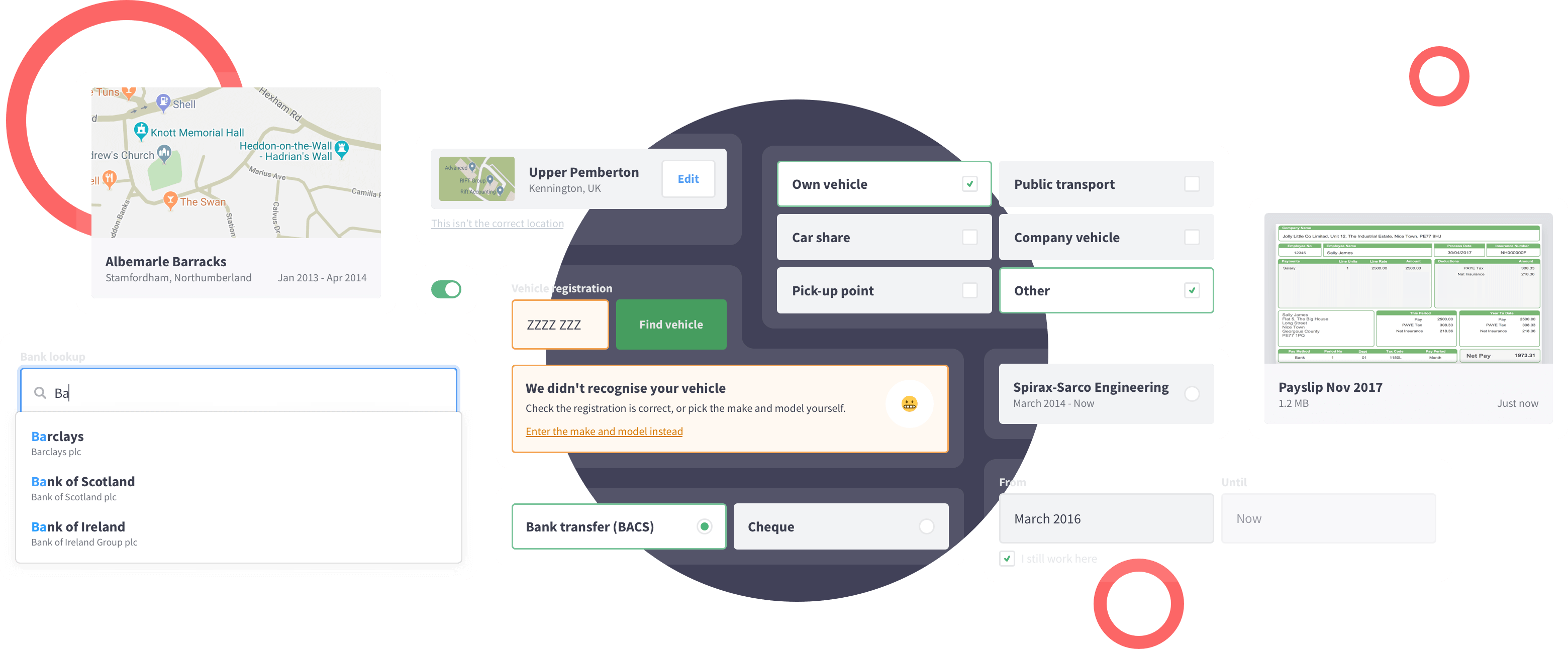

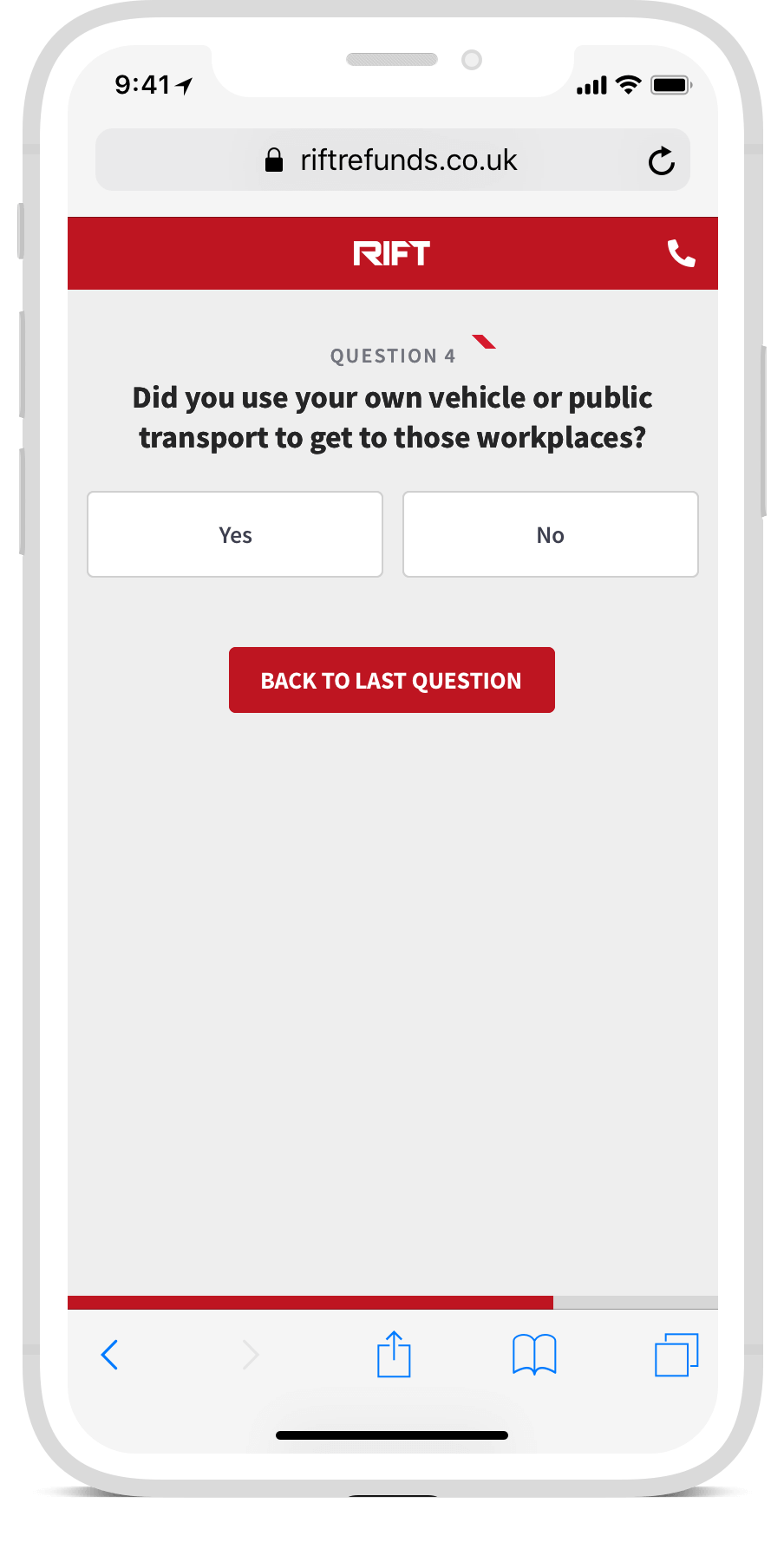

RIFT’s customer-facing claim tool, MyRIFT, wasn’t effectively converting their online leads into successful claims.

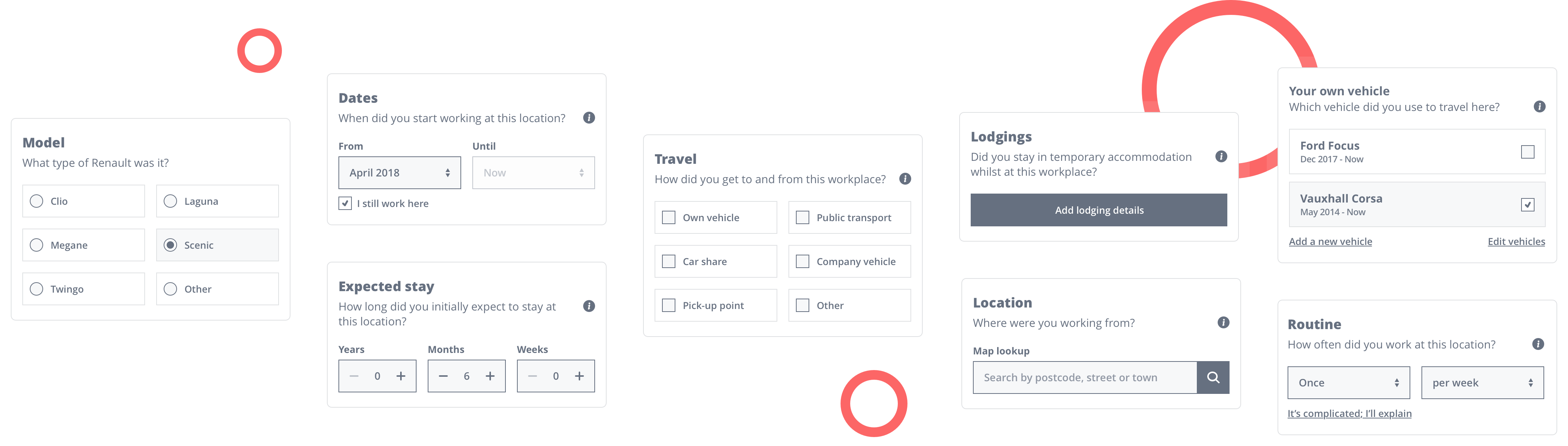

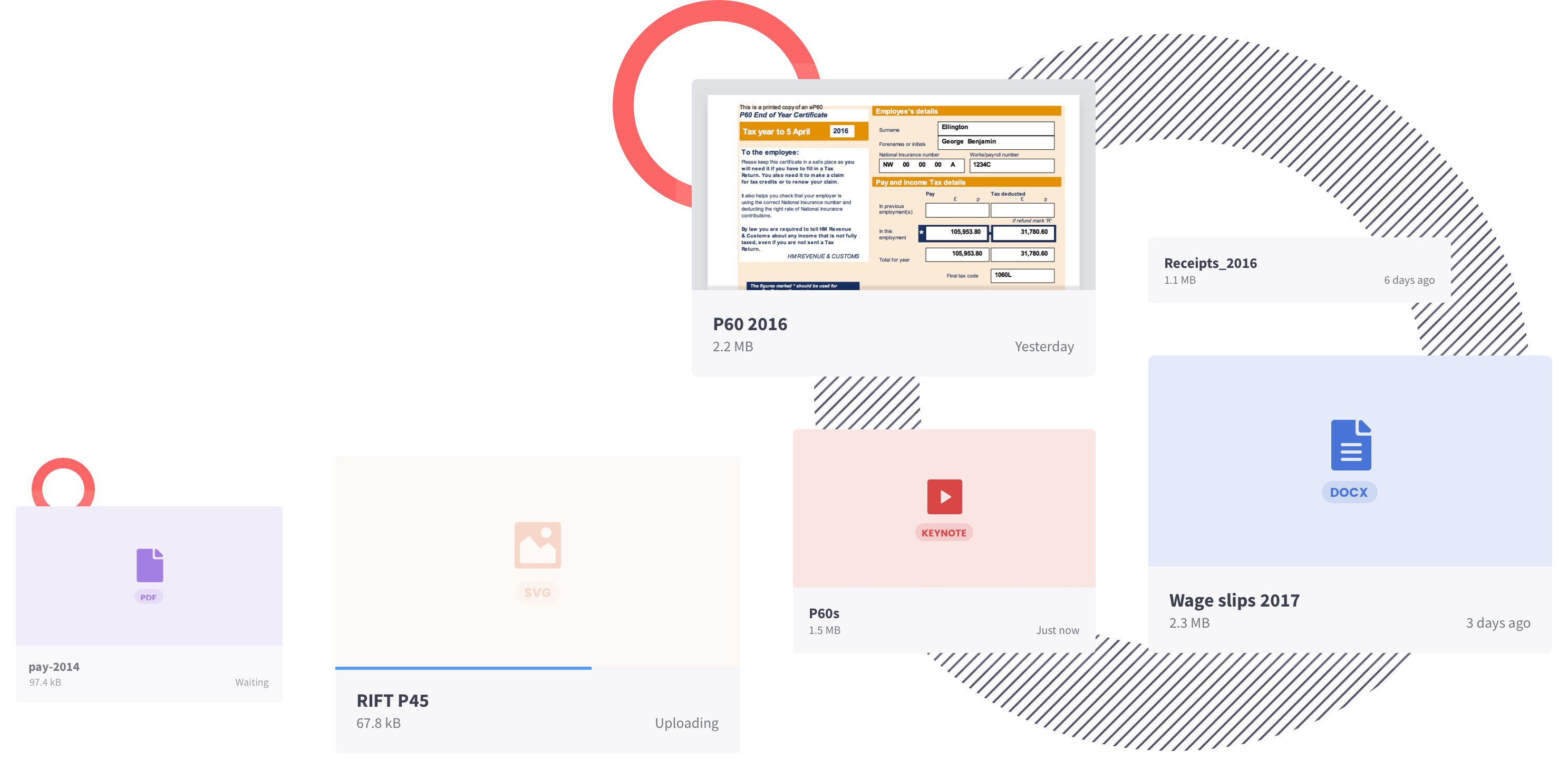

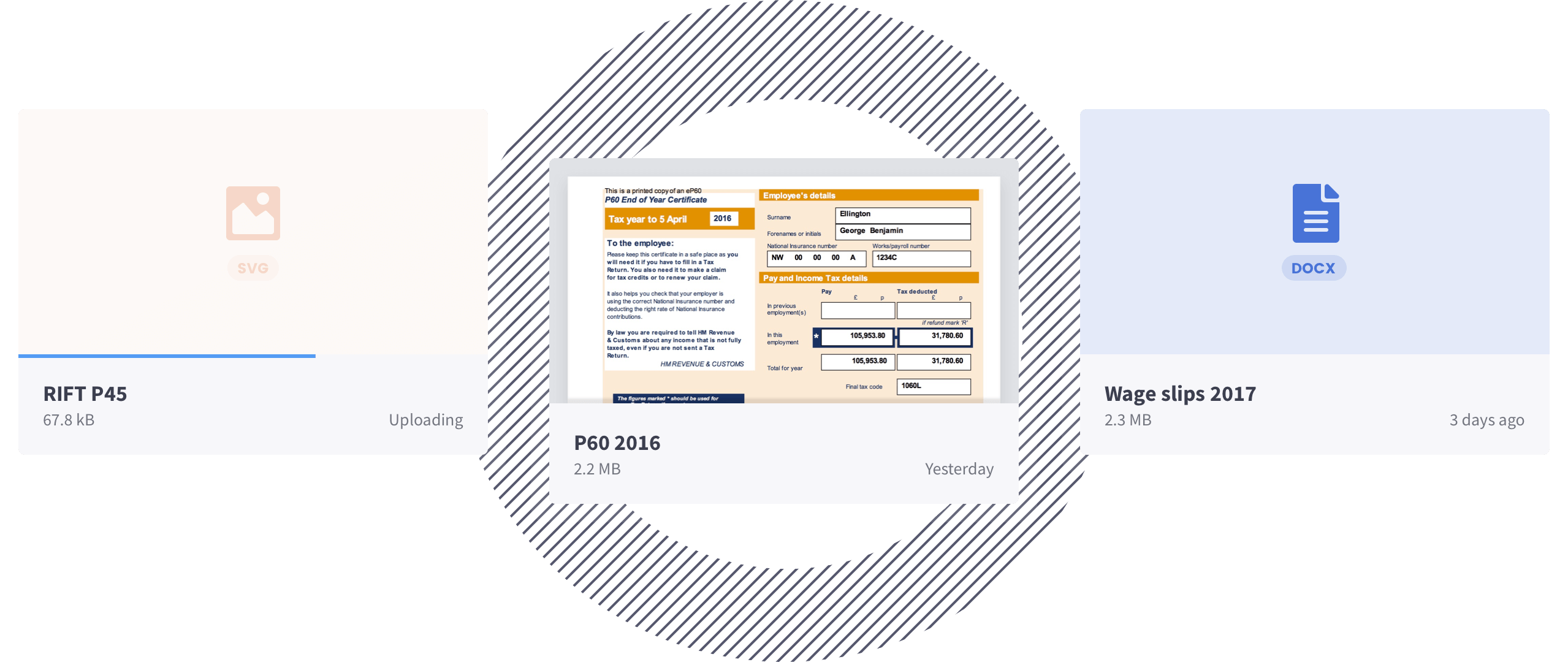

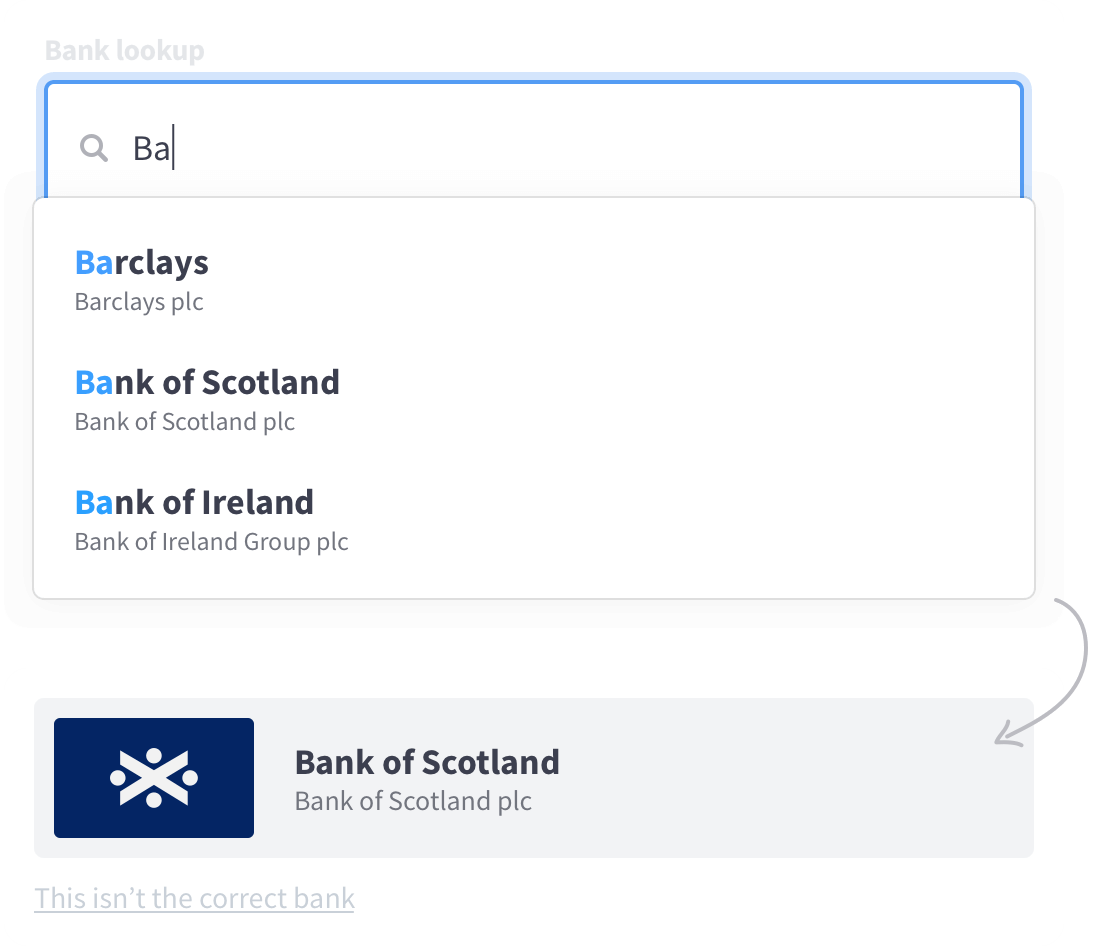

We were tasked with more effectively qualifying leads before they signed-up to MyRIFT, and to help eligible claimants submit their claim information, all the while increasing the quality of any information being captured.